📉 National Office Market in Decline (2025)

- Record‐high demolitions/conversions: In the U.S. office market, office-to-residential conversions and demolitions are outpacing new construction by a wide margin. By the end of 2025, approximately 23.3 million sf will be removed, compared to only 12.7 million sf of new office space — the first time in 25 years that teardowns outstrip completions (nypost.com).

- Persistently weak valuations: Office-building values continue sliding—prices dropped by about 11% in 2024, and are down 37% since 2019. Analysts forecast further declines through 2025–2029 (businessinsider.com).

- Elevated vacancies: With vacancy rates hovering near 19–20%, national leasing demand remains slack even as some companies attempt return-to-office initiatives (businessinsider.com).

Bottom line: Structural shifts—like remote work and functional obsolescence—are hollowing out the national office footprint. Landlords are either repurposing or liquidating underutilized office assets.

🌱 A Boise Exception: Steady Growth

Contrary to national trends, Boise’s office market displayed resilience and modest improvement in Q1 2025:

- Vacancy easing: Boise’s multitenant vacancy rate declined from 10.4% in Q4 2024 to 10.0% in Q1 2025, marking the lowest vacancy rates since mid‑2024 (TOK Commercial)

- Rising lease rates: Even with new supply hitting the market, lease rates edged up slightly—from $21.50 to $22.00/sf (FLSV, annual) (TOK Commercial).

These signs point to continued market strength in Boise, supported by consistent demand and limited new supply—quite the outlier compared to national metrics.

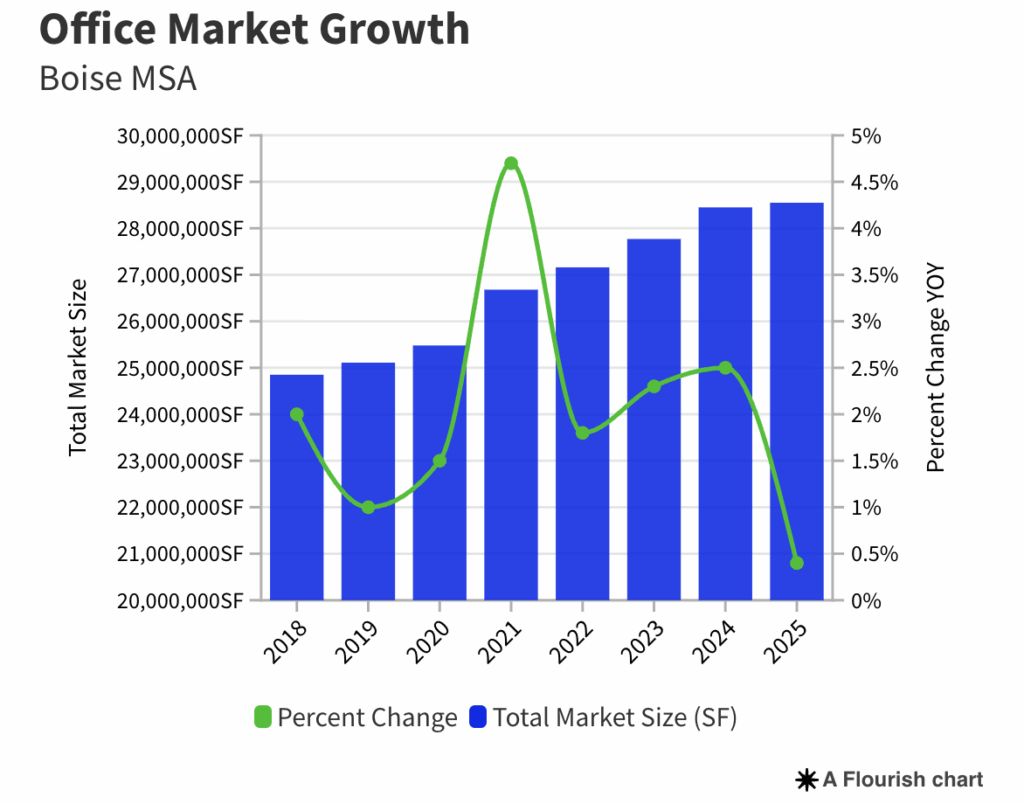

Explore TOK Commercial’s data for the Boise MSA’s market growth:

🔍 Why Boise is Bucking the Trend

- Market discipline on supply: Unlike many large metro areas, Boise hasn’t experienced a glut of speculative office projects. This restraint helped maintain healthy vacancy and absorption levels.

- Balanced demand: While Boise isn’t immune to remote-work trends, its expanding industries—such as tech, healthcare, and state government—continue to drive moderate growth in space utilization.

- Disciplined property owners: Boise’s landlords are maintaining healthy occupancy levels and favorable pricing strategies.

✅ Final Thoughts

| Market | National Office Sector (2025) | Boise Office Market (Q1 2025) |

|---|---|---|

| Vacancy | ~19%–20%, at historical highs | 10.0%, improving from 10.4% |

| Construction | 23.3M sf removed vs. 12.7M sf added | Minimal speculative supply |

| Valuation | Falling—prices dropped ~11% in 2024; another 10% decline forecast | Stable to modestly rising lease rates |

| Market Action | Conversions/demolitions ramping; prices weak | Leasing steady; conversions not yet needed |

Boise stands apart. Its thoughtfully balanced supply, local demand momentum, and steady landlord leasing decisions are producing resilience, while major markets across the U.S. are retrenching dramatically.

As the U.S. office landscape continues shrinking in 2025, Boise’s market trends indicate a disciplined marketplace delivering positive, stable consistencies.

Read more about the national office market here: