Complete Hospice Care Boise, LLC leased 2,170 square feet of office space in Sonoma Square, located at 1940 S. Bonito Way in Meridian.

Blog

JB Laser Renews Lease in Boise

JB Laser renewed their 8,750 square feet of industrial space located at 2701 Saturn Way in Boise.

Beauty Systems Group Leases Space in Idaho Falls

Beauty Systems Group, LLC leased 2,520 square feet of retail space located at 2896 S. 25th East in Idaho Falls.

Emerald Square Leases Space to Accel Realty

Accel Realty leased 850 square feet of office space in Emerald Square, located at 4355 W. Emerald St. in Boise.

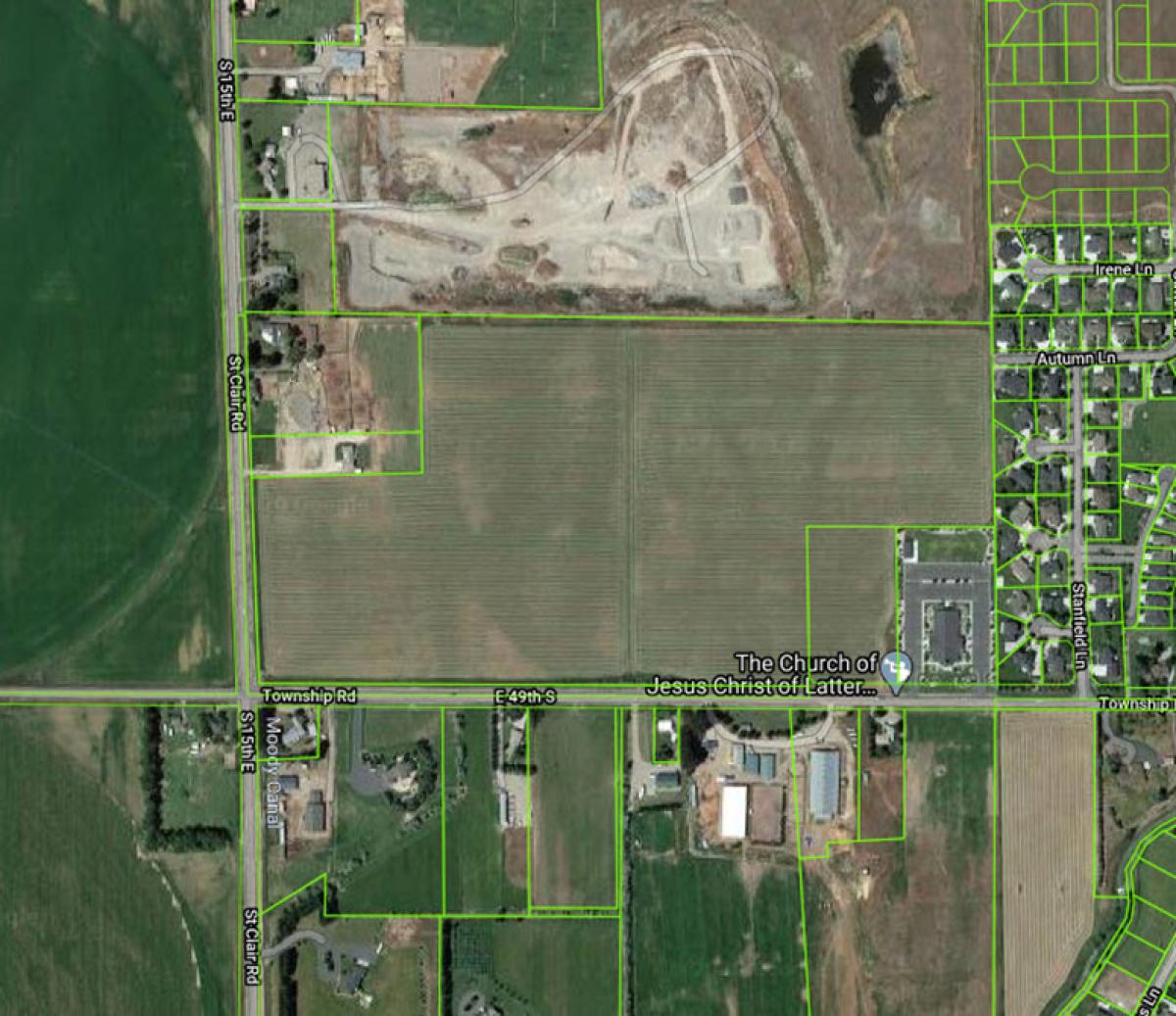

Comfort Construction Purchases Land

Comfort Construction purchased + 50 acres of land on Township Road in Idaho Falls.

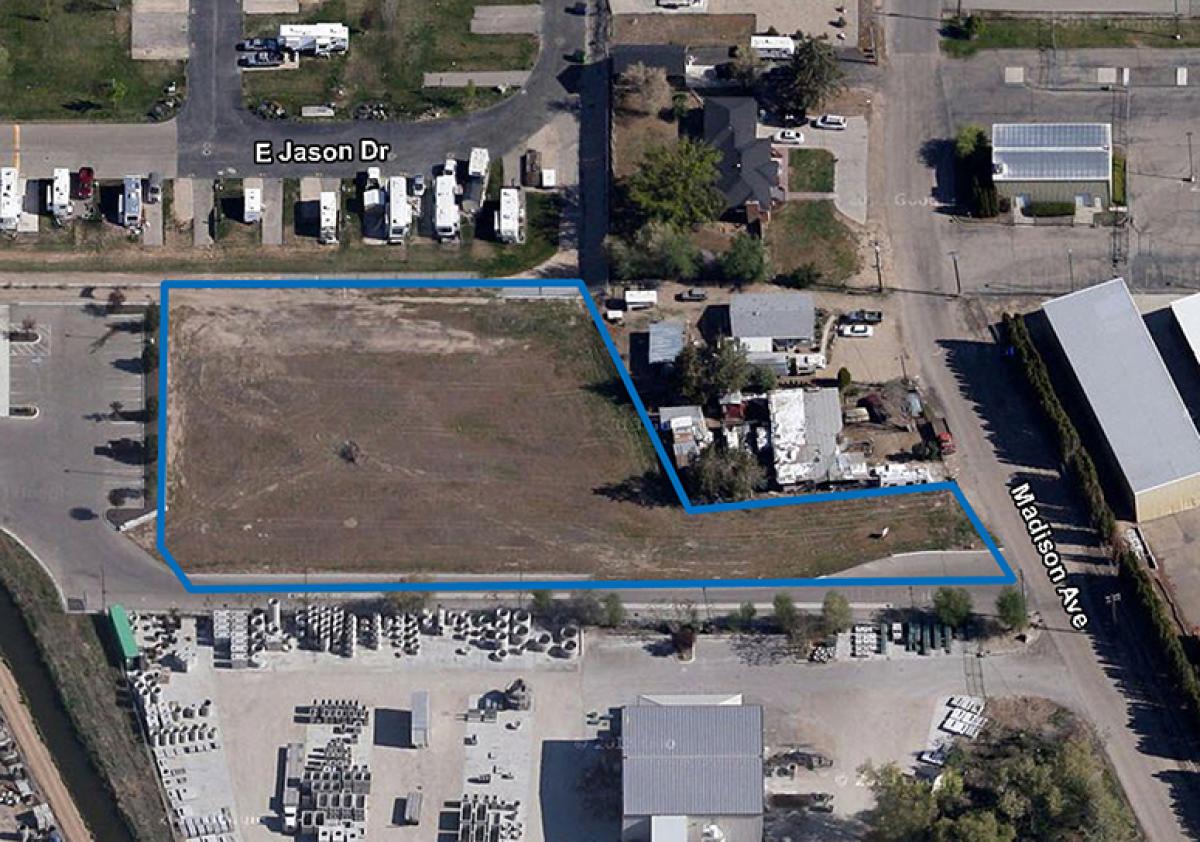

Idaho PreCast Acquires Land

Idaho PreCast purchased 1.54 acres of land located at 1417 Madison Ave. in Nampa.

West Airport Industrial Park Leases Industrial Space

Grid Manufacturing Corporation leased 17,880 square feet of industrial space in the West Airport Industrial Park, located at 2574 S. Beverly Street in Boise.

Neutron Holdings, Inc. Renews Lease

Neutron Holdings, Inc. renewed their 4,233 square feet of industrial space in Central Park Commerce A, located at 2230 S. Cole Road in Boise.

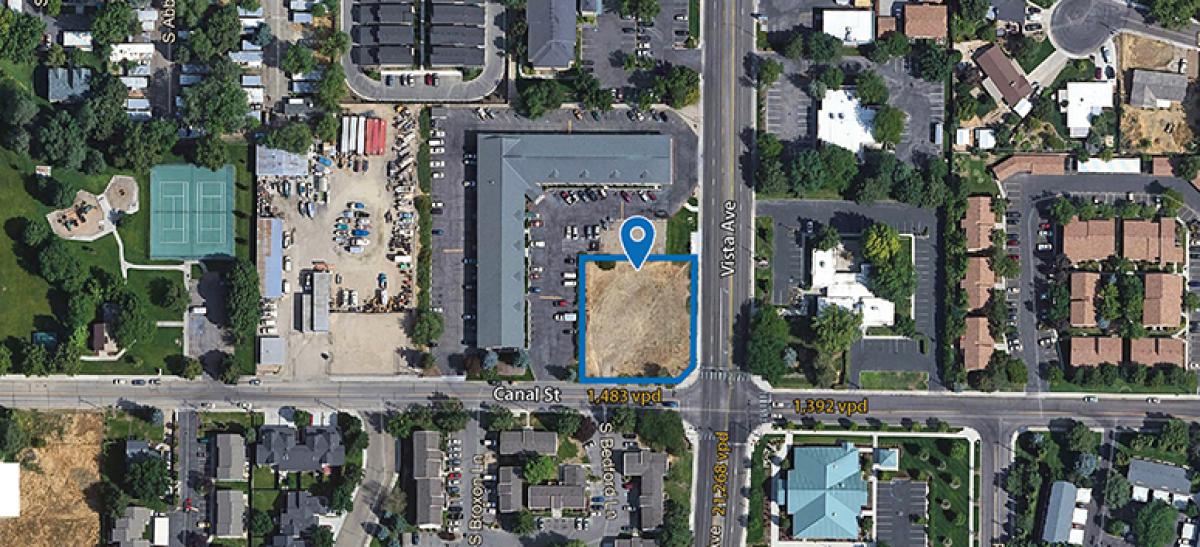

Land on West Canal Street in Boise Sells

CPS, LLC purchased 0.52 acres of land on West Canal Street in Boise.

Stericycle, Inc. Renews Lease

Stericycle, Inc. renewed their lease of 10,462 square feet located at 2855 S. Cole Road in Boise.