The Boise MSA land market has shown resilience and selective growth through the first seven months of 2025, with mixed signals across different sectors reflecting a maturing market adjusting to evolving economic conditions. Commercial land consideration over the last 12 months totaled $49.3 million, down 38 percent compared to this time last year. Despite the slowdown in land acquisition, commercial construction has surged. While commercial land transactions have slowed from last year’s pace, construction activity has accelerated, suggesting developers are starting to move forward with previously planned projects.

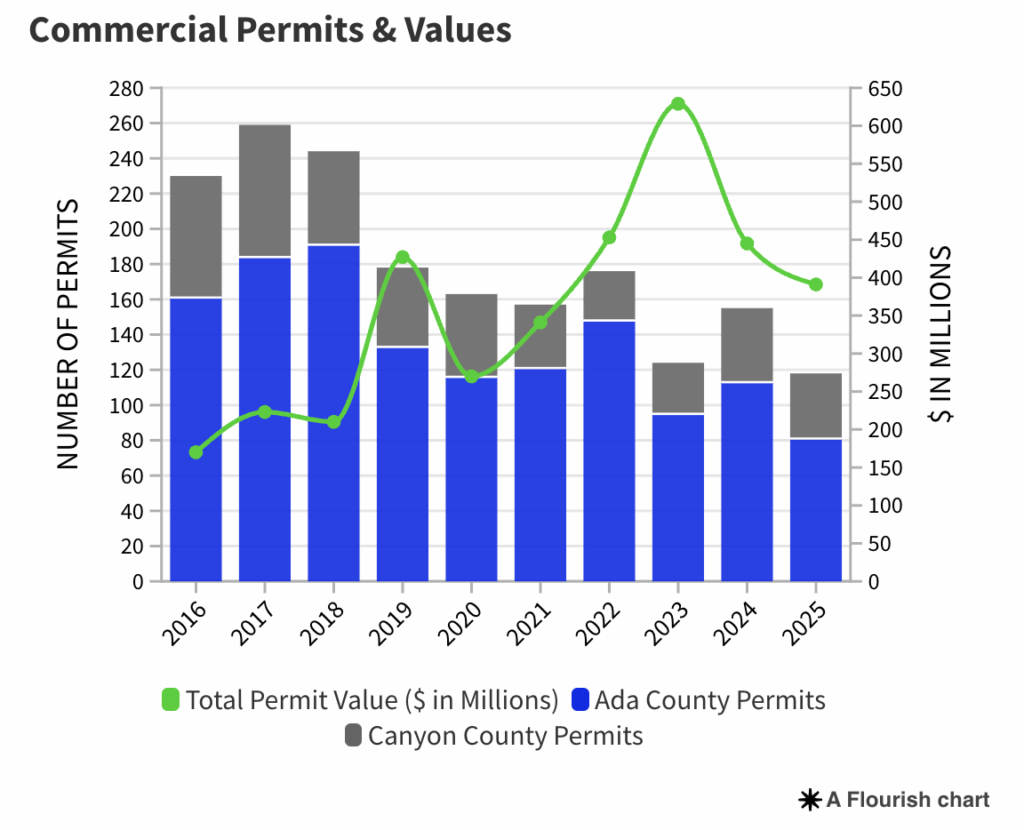

The total number of commercial permits increased nearly 17 percent to 118 permits, with values jumping over 24 percent to $391 million through July 2025. Notably, 45 percent of this permit value is attributed to construction activity at Micron, highlighting the semiconductor manufacturer’s significant impact on the region’s commercial development. In addition, Canyon County continues its growth trajectory with commercial permits up 32 percent year-over-year. Permit value increased by over 24% compared to the end of July 2024.

Total number of permits increased by nearly 17% year-over-year.

Subscribe to TOK Commercial’s Boise MSA Land Market updates, here.