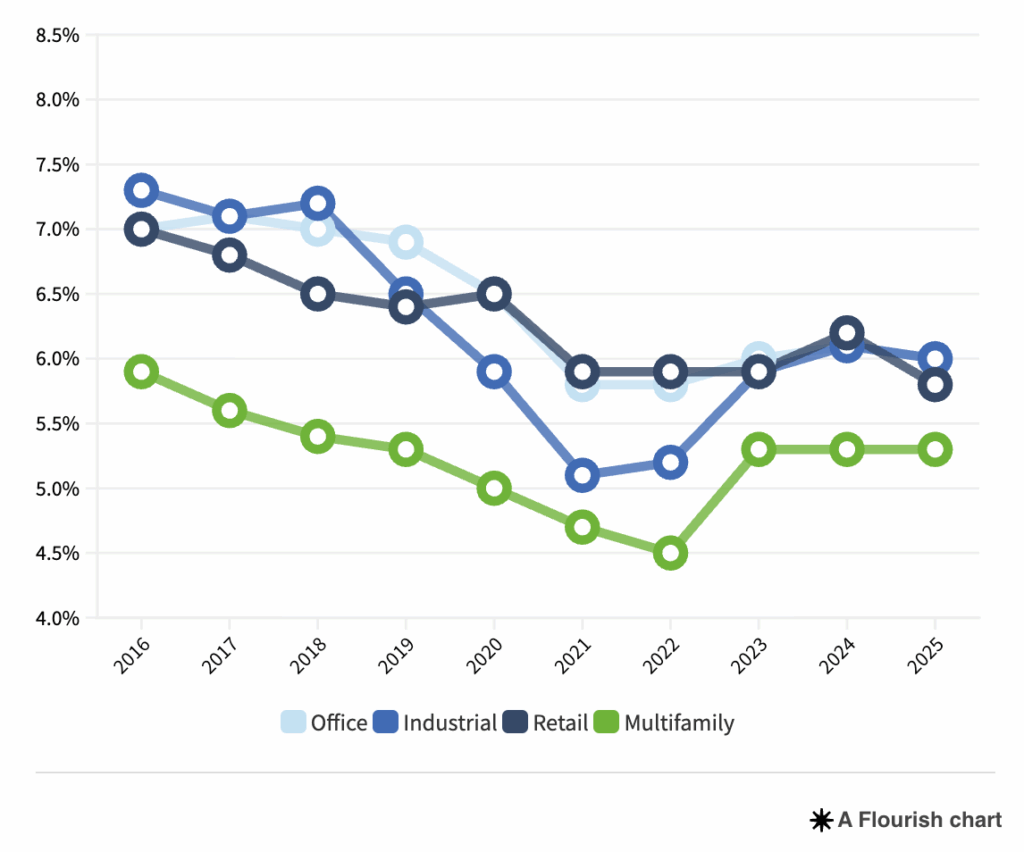

The Boise investment market continues to operate within a challenging interest rate environment, with the 10-year Treasury rate maintaining elevated levels around 4.3 to 4.5 percent throughout the first half of 2025. Multifamily maintained the lowest cap rates at 5.3 percent, followed by retail at 5.8 percent, while both industrial and office properties reached 6.0 percent. A notable divide remains between asking and closing cap rates, as many sellers continue to anchor to the record lows of recent years, creating friction with today’s market realities.

The sustained high-interest rate environment will continue to influence all investment decisions through the remainder of 2025. Any potential Federal Reserve policy shifts toward rate cuts could unlock significant transaction activity. However, until then, investors will likely remain highly selective, focusing on assets with exceptional fundamentals and prime locations that can weather continued economic uncertainty.

Boise MSA cap rates remained relatively stable across all property types in the first half of 2025. Retail showed the most improvement, compressing to 5.8%.

Subscribe to TOK Commercial’s Boise MSA Investment Market updates, here.